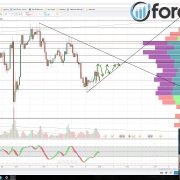

As the Dollar struggles once again with a sense of direction, Crude (US Oil) has gone on to make a new high for the year and is striving to push higher.

After it had seemed likely that the US Dollar Index (DXY) would revisit 89.700, bulls were able to push the price back above 90.00. Traders have seen the DXY do this for the past 4-6 weeks as the long-term downtrend has come to a consolidated halt.

Regardless of the Dollar, Oil has a more optimistic outlook. Today’s daily candle will close as a sizable bullish hammer which is a good sign as this candle will be able to close above this year’s high. With economies continuing to reopen, fundamentals alone should take oil higher.

Sometimes in trading, you have to pick your poison. If the majors aren’t providing trade setups, try the minors. If the minors aren’t providing trade setups, try the commodities. In the end, the best possible trade setup available should be entered.

Directory:

- Sign up for a Free Membership.

- Login to watch full recorded webinars in our Forex Trading Room.

- Chat with our traders in the Community Discord Server.

- Read yesterday’s breakdown: US Oil in Further Profits + Gold Longs Set for Entry