What Is A Forex Managed Account?

A Forex Managed Account is where a professional trader, account manager, or money manager manages the trading on the clients’ behalf through a MAM or PAMM solution. Forex Managed Accounts can be compared to traditional investment accounts in stock trading where the investment manager handles the trading analysis, risk management, portfolio management, and other trading logistics.

What is a PAMM Account?

A PAMM Account in Forex trading is also known as a Percentage Allocation Management Module Account. It is a software solution that allow traders and investors to attach a sub trading account to a specific money manager or asset manager’s “master” account. The sub account will take the same trades as the master account using the same % risk, or a multiple of the risk %.

What is a MAM Account?

A MAM Account in Forex trading, also known as a Multi-Account Manager Account, is a solution that allow forex traders and investors to become part of a “pool” of sub accounts traded through a “Master Account“. The total trading capital in the master account is equivalent to the total of all the sub accounts, and profits are distributed according to the contributions to the master account. This is all calculated by the broker each month.

What are the Advantages of using Forex Managed Accounts?

- No Commitments or recurring subscriptions fees

- No Performance fees unless profits are made on the account

- Performance fees are calculated on a High Watermark policy

- Does not require any trading experience at all

What Is High Watermark?

High Watermark is the highest peak in value that the Forex Managed Account has reached. The high water mark ensures the money manager does not get paid a performance fee for poor performance. For example, if the money manager goes on a losing streak over a period of time, he must get the trading account above the high water mark before eligible to receive a performance fee.

Example: Let’s assume you deposited an initial $10,000 with our Smart FX Managed account which charges a 30% performance fee. During your first month with us, we make 10% return. Your original investment is now worth $11,000 with a total net profit of $1,000. This $1,000 is split between the trader at Forex Lens and you where the trader will receive 30% which is $300, and you will keep 70%, which is $700. Your new high water mark will be $11,000 and you will only have to share profits on gains earned above this high watermark number. Read more about how high water mark works by clicking here.

What is the Minimum Deposit to Participate?

The minimum deposit to participate in our Forex Managed Accounts is $10,000.

Can I Withdraw from the Managed Account at any time?

Yes, you will find the option to exit or disconnect your managed account in the broker’s back office. If you cannot find this option, simply speak to an agent at the brokerage and they will be happy to assist you. We also recommend speaking with us directly to determine the optimal time to initiate a withdrawal funds.

Are there any Restrictions with Withdrawals?

There are absolutely no restrictions when it comes to withdrawing. This is one of the many benefits of trading with us. You can withdraw at any time if you are unhappy with our trading.

Who Can Withdraw Funds From My Managed Forex Account?

As per all our trusted brokers’ internal withdrawal policies, all trading funds can only be withdrawn by the account holder, who initially funded the account. In other words, any third party withdrawals are prohibited.

FX Choice

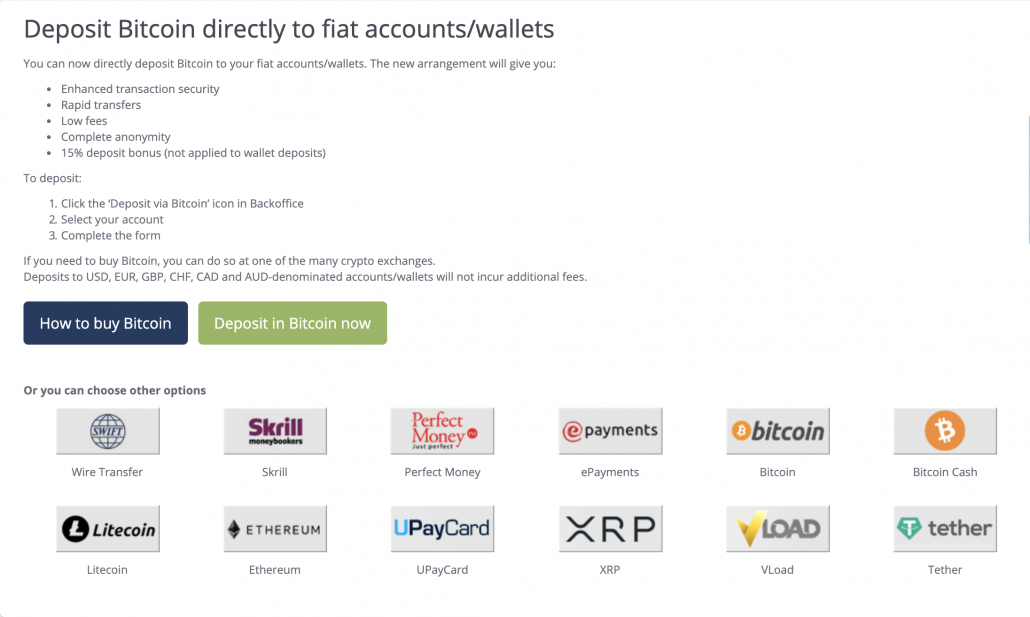

You can deposit via any of the following methods: Wire Transfer, Skrill, Perfect Money, ePayments, Bitcoin, Bitcoin Cash, Litecoin, Ethereum, UPayCard, XRP, VLoad, and Tether.